This is part of our Malaysian Fintech Race article series:

In the past few years, the way Malaysians handle money has completely changed. It’s no longer just about your traditional bank. It’s a three-way race for your daily transactions, your savings, and your trust.

You have:

- The “TradFi” Incumbents: The giant banks (like Maybank, CIMB).

- The E-Wallet Giants: The daily conveniences (like TnG eWallet, GrabPay).

- The New Disruptors: The app-first Digital Banks (like GXBank).

But who is actually winning this race? Not in terms of customers, but in terms of public conversation and, most importantly, sentiment?

We used the Mediapod platform to analyze 727 public mentions from Google News and Reddit over the past 12 months (Nov 2024 – Oct 2025). Here’s what we found.

Part 1: Who Dominates the Conversation? (Share of Voice)

First, we just looked at volume. When people in Malaysia talk about their finances online, who do they talk about most?

Unsurprisingly, the Traditional Banks (TradFi) are still the 800-pound gorilla, with 437 total mentions, making up the bulk of the conversation. The E-Wallets (160 mentions) and the new Digital Banks (99 mentions) are still competing for a smaller piece of the pie.

The Insight: Traditional banks are the default. Their sheer size means they are still the center of the financial universe. But volume doesn’t tell the whole story.

Part 2: Who is the Most Frustrating? (The Sentiment Story)

This is where the story gets fascinating. We used our Deep Emotion Analysis to score the sentiment of every mention.

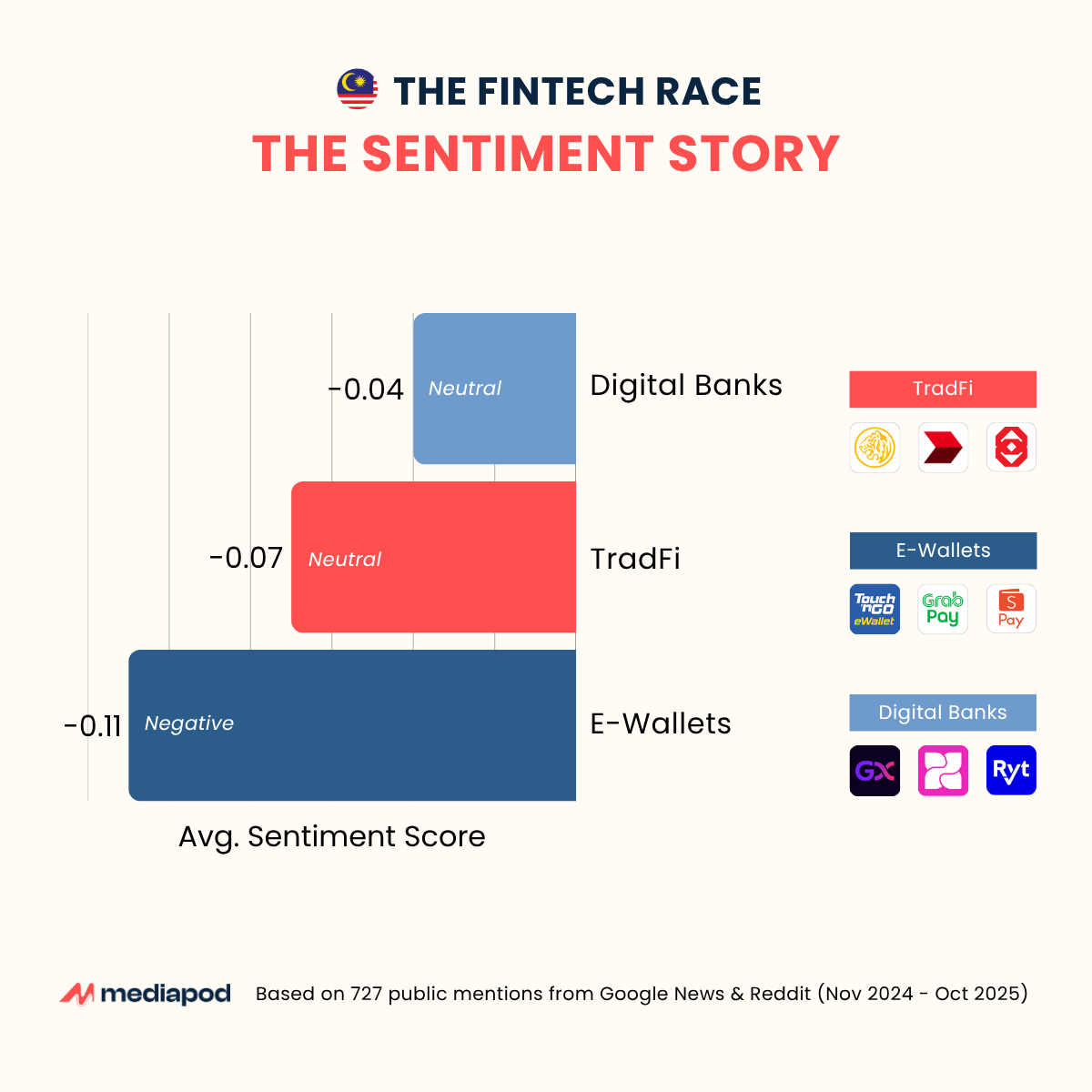

(A quick note on how we score: -1.0 to -0.1 is Negative, -0.1 to +0.1 is Neutral, and +0.1 to +1.0 is Positive.)

The data reveals that E-Wallets are, by a margin, the most negatively discussed category (-0.11).

Both the TradFi banks (-0.07) and the new Digital Banks (-0.04) are holding steady with an overall Neutral sentiment.

Conclusion: What This Data Really Means

This data snapshot paints a powerful picture of the Malaysian fintech landscape:

- TradFi & Digital Banks Are on Neutral Ground: Despite common complaints about app downtime (for TradFi) or launch issues (for Digital Banks), the overall sentiment for both is balanced. They are meeting baseline expectations.

- The Real Frustration is with E-Wallets: The data shows that the E-Wallet category—which includes the most-used daily apps—is the primary source of public frustration. The conversation here is clearly driven by pain points like fees, rewards, and usability issues.

- The Opportunity: This is a golden opportunity for the new Digital Banks. They have launched with a neutral reputation. If they can solve the key problems that are frustrating E-Wallet users (like high fees or poor value) and avoid the app performance issues of the TradFi banks, they are in a perfect position to win the market’s trust.

The race is far from over, but the data shows that the brand that can fix the E-Wallet experience has the most to gain.

This article is just one part of the story. We’ve analyzed the entire landscape—from TradFi giants to Digital challengers—in one comprehensive report.

Read the full case study: The Fintech Race in Malaysia