This is part of our Malaysian Auto Race article series:

If you look at the sales charts for 2025, the story seems simple: Perodua and Proton are the kings of the road.

But if you look at the digital charts, the story changes completely.

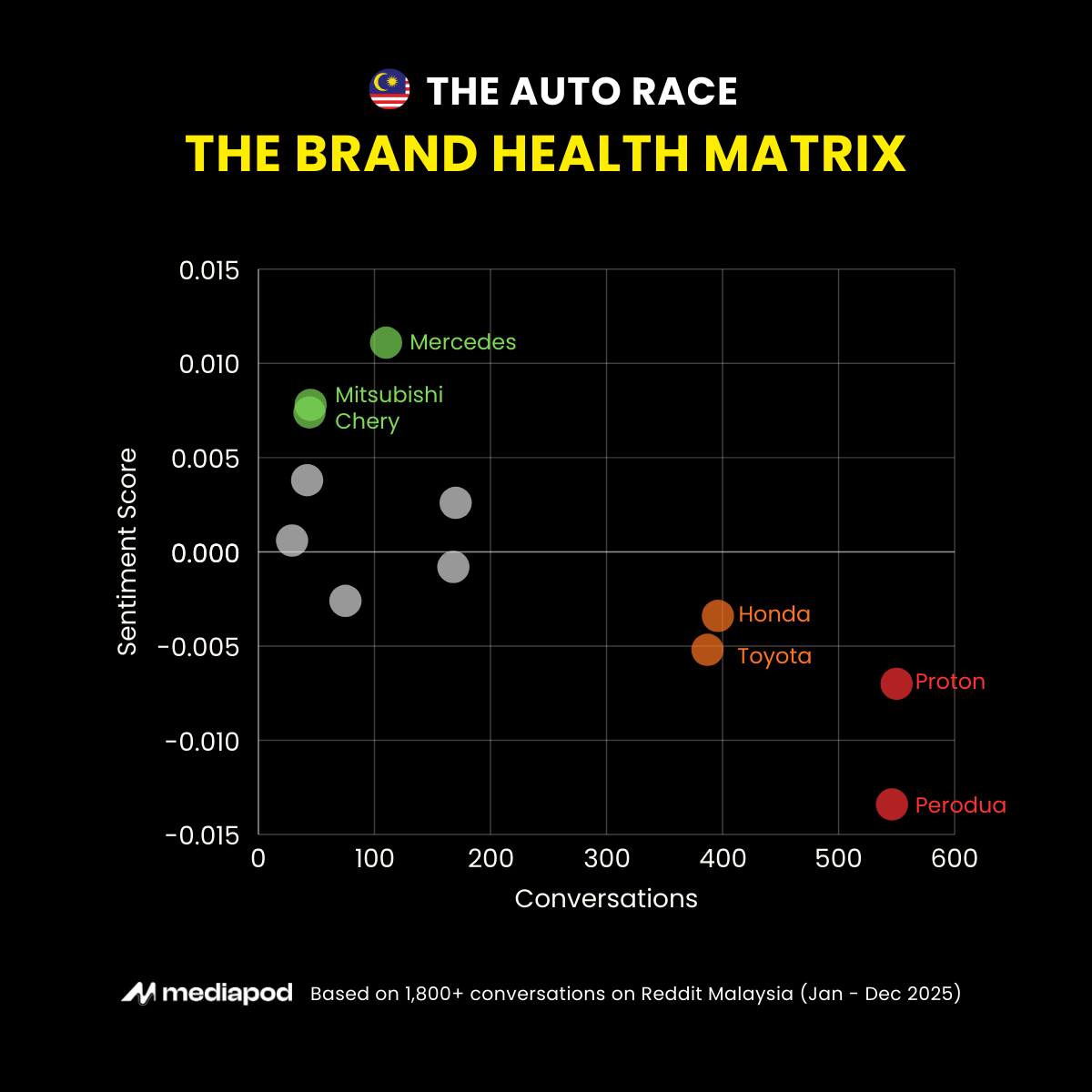

At Mediapod, we analyzed over 1,800+ unique conversations from Reddit Malaysia’s automotive communities (Jan 1 – Dec 14, 2025) to understand what Malaysians are really saying about their cars.

The results reveal a stark “Sentiment Gap.” While the local giants dominate the conversation volume, they are losing the war for “Brand Love.” Meanwhile, a new wave of challengers is winning hearts and minds.

Here is the data-driven reality check for the Malaysian auto industry.

The “Big Two” Paradox: High Visibility, Negative Vibes

Unsurprisingly, Proton and Perodua own the lion’s share of the conversation. Together, they account for nearly 60% of all unique discussions we tracked.

- Proton: 550 Unique Threads

- Perodua: 546 Unique Threads

However, volume does not equal validation. Both brands recorded negative net sentiment scores (-0.007 and -0.013 respectively).

Why the negativity? Deep-diving into the topic clusters, the conversation isn’t about “hating” the national cars—it’s about frustration.

- Waiting Periods: “Booking to delivery” times remain a massive pain point.

- QC Issues: Specific complaints about “power window” legacy issues and gearbox anxieties still plague the comment sections.

- The Takeaway: Malaysians view these cars as a necessity, not a desire. They talk about them because they have to, not because they want to.

The “Good Vibes” Winner: Mercedes-Benz

If Proton is the “husband you argue with,” Mercedes-Benz is the “dream date.”

Despite having only 20% of the conversation volume of the local brands, Mercedes-Benz recorded the highest positive sentiment score (+0.011) of any major automotive brand in 2025.

What is driving the love?

- Aspiration: Conversations are focused on “goals” and “dream cars.”

- Tech & Comfort: Unlike BMW (which saw negative sentiment driven by maintenance talks), Mercedes owners are discussing features, interiors, and the lifestyle upgrade.

The “China Tech” Halo: Chery & Jaecoo

The biggest surprise in the 2025 data isn’t from Germany; it’s from China.

Chery and Jaecoo are punching way above their weight class.

- Chery: Ranked #3 in overall sentiment (+0.007).

- Jaecoo: Ranked #6 in sentiment, beating Honda and Toyota.

The “Vibe Shift”: For decades, “Non-National” meant “Japanese.” In 2025, that default is breaking. The data shows Malaysians are genuinely excited by the “Price-to-Tech Ratio” of Chinese brands. The conversation isn’t about “reliability” (Toyota’s stronghold); it’s about “value for money” and “next-gen features.”

Conclusion: The “Trust vs. Tech” Battlefield

The 2025 data draws a clear line in the sand.

- Local Brands: Need to fix the experience (waiting times, QC) to turn volume into advocacy.

- Japanese Brands: Are stuck in the “middle,” fighting a defensive war on value.

- Chinese & Premium Brands: Are currently owning the “excitement” factor.

For automotive marketers, the lesson is clear: Stop counting mentions and start reading the room. You might be winning the Share of Voice, but you might be losing the Share of Heart.

🏁 See the Full Race Results

This insight is just one lap of the race.

From the EV Hype Index to the Luxury Service War, we analyzed 1,800+ consumer conversations to map the entire 2025 Malaysian Automotive landscape.

Don’t rely on guesswork. Get the complete data story.